Why Overseas Now Outpaces Domestic

In recent cycles, the English Premier League (EPL) has crossed a watershed: its international media rights revenues now exceed its domestic ones. This is not a trivial shift — it’s a structural transformation in how top-tier football finances itself, and it has profound implications for league competition, global branding, and strategy. In this article, we’ll unpack how this happened, what it means, and what lessons other leagues can draw.

The Historical Model: Domestic First, International as Bonus

Historically, most major football leagues derived the majority of their broadcasting income from their home markets. Domestic audiences (pay TV, free-to-air, subscription packages) were reliable, easier to monetize, and less risky in terms of rights enforcement and regulation. International rights were often sold incrementally, territory by territory, with limited scale and bargaining power.

In England’s case, before globalization accelerated, domestic broadcasters like BSkyB (Sky) and BT held the lion’s share of EPL revenue. For decades, the value of UK consumption—footfall, television subscribers, advertiser leverage—dominated the business model. Over time, international rights served to enhance revenue further, but domestically was still king.

However, in recent cycles, the balance has tipped.

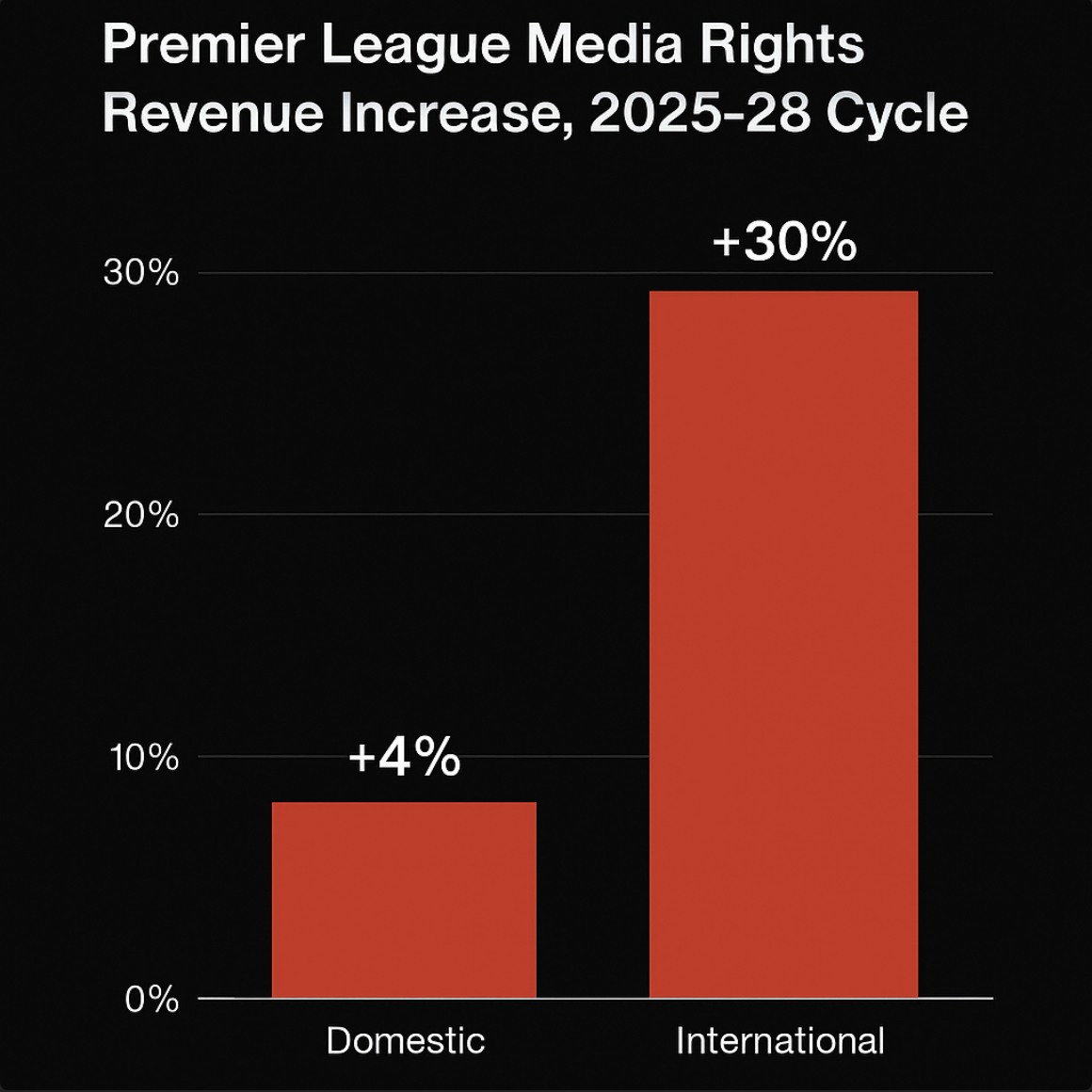

Evidence of a Shift: Domestic vs International in the 2020s

Let’s examine the numbers, as publicly reported and estimated, to see how the shift has taken place.

- In the 2022–2025 rights cycle, the Premier League’s international TV rights reached ~£5.3 billion, compared with ~£5.1 billion for domestic rights.

- For the upcoming 2025–2029 domestic cycle, the EPL has secured £6.7 billion in domestic rights — a record for the UK market.

- But international rights for the 2025–2028 period are projected at £6.5 billion, thus surpassing domestic for the first time in absolute value.

- In many commentary pieces, it is noted that the international “pillar” has become the primary driver of growth.

- SportsPro reported that Premier League TV + commercial revenues grew 17% year-over-year, reflecting how global media and sponsorship are fueling expansion.

Thus, whereas previously international rights were supplemental, now they are equal to — or in fact exceed — domestic rights in total value.

What factors enabled this inversion? Let’s dig into the mechanisms.

Why the Inversion Happened: Key Drivers

1. Global Fan Base & Consumption Demand

The Premier League is broadcast in 212 territories, reaching hundreds of millions of households. That scale — combined with the league’s branding and star power — allows media companies to bid aggressively in non-UK markets.

Because domestic growth in the UK is approaching saturation (e.g. limits on incremental pay-TV subscriptions, market maturity), major growth is possible only outside. In contrast, many countries with growing middle-class populations, increasing broadband penetration, and rising sports consumption are eager to license marquee European football content.

2. Centralized Rights Sales & Packaging

Unlike some leagues where individual clubs negotiate their own deals, the Premier League sells rights centrally. It can package territories, bundle rights, negotiate large aggregated deals, and hold stronger bargaining power. This central control is pivotal in maximizing international value.

This approach ensures consistency of product (production standard, commentary, branding) and provides a unified offering to broadcasters globally.

3. Streaming & Digital Platforms

The emergence of global streaming platforms and OTT services has lowered distribution friction. Where once a broadcaster in a foreign territory had to invest heavily in infrastructure and local content adaptation, new digital platforms make it more feasible to offer EPL content globally. This expands demand and enables exploring “long tail” markets that would have been too small under traditional broadcasting models.

Hence, the EPL can monetize low-density markets which — in aggregate — contribute meaningfully.

4. Escalation & Competitive Bidding Dynamics

In many markets, European football (and especially the EPL) is seen as premium content. Bidders compete in a zero-sum struggle for sports rights, pushing prices upward. In markets where EPL competes against fewer local sports alternatives, rights carry strategic value for broadcasters seeking subscriptions, brand differentiation, or subscriber retention. This drives up international rates.

In the UK domestic market, competition is more mature and margins narrower, constraining how high pricing can go without viewer backlash or regulatory scrutiny.

5. Commercial Synergies & Sponsorships

Media rights are no longer solely about broadcasting. They tie into sponsorship, merchandising, digital content, and brand activation. The global reach of the Premier League gives advertisers international exposure, making the rights more attractive. Rights packages are often sold alongside commercial partnerships, merchandising tie-ins, and multi-platform rights, which increases the total value in international markets.

6. Maturity Constraints of UK Market

The UK market has regulatory, competitive, and saturation constraints. Pay-TV penetration has ceilings; many households may already subscribe. Advertising rates have limits. Viewer resistance to high subscription fees or “subscription fatigue” can restrain price escalation. Thus, marginal increases domestically are harder to achieve than in markets where sports demand is still growing.

All these elements combine to push the EPL’s upside energy into international monetization.

Implications for Revenue, Competition & Sustainability

This inversion carries several strategic consequences:

- Risk Diversification: Overreliance on the UK market is reduced. If domestic consumption weakens (e.g. due to economic downturn, regulation, viewer fatigue), the league has a global buffer.

- Distributive Effects: Because overseas revenues are distributed equally (in the EPL’s scheme), smaller clubs benefit from global growth rather than only the top clubs.

- Pressure on Rival Leagues: Leagues that remain heavily dependent on domestic markets (e.g. La Liga, Serie A, Ligue 1) face more vulnerability to domestic cycles, regulatory shifts, or stagnation.

- Escalating Player Costs & Inflation: More money available globally fuels higher spending, wages, and transfer fees, which increase cost pressures.

- Global Branding & Club Expansion: Clubs are more incentivized to internationalize (preseason tours, digital content, academies, merchandising) because global exposure has real monetizable value.

- Regulation & Competitive Balance Pressure: As foreign revenues dominate, questions of revenue sharing, financial fair play, and financial governance acquire new complexity.

What Other Leagues Can Learn — and How to Move the Dial?

If you are a league executive, a federation, or a rights-holder in a domestic or regional league, here are strategic pathways, challenges, and recommendations—based on what the Premier League’s trajectory reveals.

Why Many Leagues Lag?: Structural Barriers

Before prescribing steps, it’s important to recognize why many leagues haven’t replicated this model:

- Lack of Centralized Marketing Power

Some leagues do not package rights centrally or lack cohesive control over clubs’ rights, leading to fragmented deals and weaker negotiating power abroad. - Brand Weakness or Global Visibility Deficit

Not every league has global star appeal, iconic clubs, or branding that translates well in foreign markets. Without global fan bases or star players, it’s harder to demand high rates. - Low Production Quality / Infrastructure Limitations

International broadcasters expect high production standards (multi-camera, high-definition, commentary, studio segments). Leagues lacking production capacity or standards may face discounting. - Regulation, Rights Fragmentation & Protectionism

Some markets enforce local quotas, exclusivity curbs, or “no single buyer” rules to prevent media concentration (e.g. Italy is moving to scrap its “no single buyer” rule). Reuters

Such regulation can limit how aggressively media rights can be packaged or sold. - Digital & Distribution Barriers

In many territories, broadband penetration is low, payment infrastructure is immature, piracy is rampant, and platform trust is weak. - Risk Aversion & Conservative Strategy

League boards may resist exporting rights aggressively, preferring the known security of domestic income rather than betting on uncertain foreign markets.

Given this, here is how a league can begin to reshape its media-rights strategy.

Strategic Recommendations: From Vision to Execution

1. Define Global Branding & Positioning

- Identify Unique Selling Propositions (USPs) — star players, marquee derbies, style of play, cultural identity — and build a narrative.

- Develop flagship content — highlight reels, mini-series, storytelling around clubs, legends, rivalries — to entice global audiences beyond just matches.

- Localize marketing — in target territories, produce commentary in local languages, regionalized promos, contextual storytelling to attract new fans.

2. Build a Centralized Rights Sales Unit

- Consolidate media rights under a central corporate/legal structure, rather than club-by-club sales.

- Invest in rights-sales expertise: hire international media negotiators, brokers, regional agents with local knowledge.

- Bundle rights across platforms and territories, offering multi-year guarantees and cross-border packages to reduce fragmentation.

3. Raise Production & Broadcast Quality

- Ensure high technical standards (HD / 4K, multiple camera angles, studio segments, high-quality commentary and graphics).

- Use centralized production or partner with experienced global production firms to deliver uniform quality.

- Innovate with interactive features (multi-view, real-time stats, second-screen experiences) to differentiate.

4. Leverage Digital & OTT Platforms

- Build or partner with streaming platforms that can reach global audiences, offering flexible packages (e.g. pay-per-match, subscriptions, bundles).

- Offer regionally tailored pricing, free trial windows, or hybrid free/ad-supported models in emerging markets.

- Use data analytics to understand viewership patterns, retention, and to cross-sell merchandise, betting partnerships, or hybrid content.

5. Prioritize Market Entry & Window Strategy

- Start with markets of diaspora or cultural affinity (e.g. countries with historical, linguistic, or cultural ties), which are more predisposed to adopt your content.

- Use “loss leader” deals initially—smaller deals or low-margin entry to build presence, viewership, and brand, then scale pricing upward in future cycles.

- Stagger entry by territory, allowing time to localize content, market, and build partnerships.

6. Layer Commercial & Sponsorship Integration

- Bundle media rights with sponsorship or merchandising rights, enabling cross-value capture.

- Use global sponsors whose activation works across multiple territories, making rights more valuable.

- Leverage data from media consumption (viewer demographics, engagement metrics) to sell premium advertising and digital sponsorship.

7. Enforce Anti-Piracy & Rights Protection

- Develop legal and technical anti-piracy infrastructure, regional enforcement partners, and robust license monitoring.

- Educate consumers and broadcasters in markets about authorized platforms; provide accessible, reasonably priced legal options to disincentivize piracy.

8. Revenue Sharing & Internal Incentives

- Structure revenue sharing in ways that protect competitive balance. For example, distribute international rights equally (or with modest merit adjustments) to ensure league-wide buy-in.

- Provide incentives (bonuses, investment grants) to clubs for participation in international branding, content production, or touring.

9. Iterate, Monitor, Adapt

- In each rights cycle, analyze which markets underperform or overperform, adjust packaging, platform strategies, pricing, and promotion.

- Use metrics (viewership, retention, ARPU — average revenue per user) to guide decisions.

- Be willing to re-negotiate, re-bundle, or scale back in underperforming territories.

Why It Works (If Done Right)

- Scalable Growth: Overseas markets still have much headroom in many parts of the world (Africa, Southeast Asia, Latin America).

- Leverage Globalization & Connectivity: Internet, streaming, mobile devices collapse distance, making borders less relevant.

- Risk Mitigation: Dependency on one market becomes untenable in volatile or saturated domestic environments.

- Commercial Leverage: International reach enhances sponsorships, merchandise sales, digital activation — making the property more valuable holistically.

- Positive Externalities: Growing international fandom can drive tourism, brand licensing, stadium tours, talent pipelines, etc.

However, the transition takes strategic commitment, capital investment, patience, and iterations. There is no overnight “flip a switch” solution.

Why This Matters to Stakeholders?

- League Executives & Federations: Recognize that your growth ceiling domestically may be limited; the next frontier is global monetization.

- Media Companies & Platforms: Understanding this shift explains why they are bidding aggressively for rights globally and pursuing strategic partnerships.

- Club Owners / Investors: The value of your club is increasingly linked to its global brand, not just its performance in local markets.

- Sponsors & Commercial Partners: Advertising tied to a league that has global reach is more valuable — and that can justify premium deals.

- Fans & Markets: The content, access, and fan experience may evolve: more global commentary, multiple languages, alternative streaming modes.

Let’s talk

You’ve seen the structural shift: the Premier League’s triumph in monetizing its global footprint is more than an outlier — it’s a blueprint for how modern sports media economics can evolve. If you’re a league, federation, or rights-holder in Asia, Africa, Latin America, or anywhere aiming to “go global,” there’s an untapped path you can walk — but the execution details, models, and roadmap differ per market. Let’s talk

Don’t Just Watch Sport, Understand It. Join the 365247 Newsletter for daily insights