Soho House & Co, the global members’ club operator, is set to leave the public markets after agreeing to a $2.7 billion deal led by MCR Hotels, one of the largest hotel groups in the United States.

The move comes just four years after Soho House listed on the New York Stock Exchange, a period marked by financial struggles and a volatile share price.

The Deal Structure

- New investors led by MCR Hotels will acquire publicly traded shares at $9 per share, representing an 83% premium to the stock price before takeover interest emerged in December.

- The transaction values Soho House at around $2 billion in equity, alongside $700 million in debt, bringing the total enterprise value to $2.7 billion.

- Existing investors, including founder Nick Jones (5%), billionaire Ron Burkle (40%), and restaurateur Richard Caring (21%), will retain their stakes. Goldman Sachs also continues to hold its 8% share.

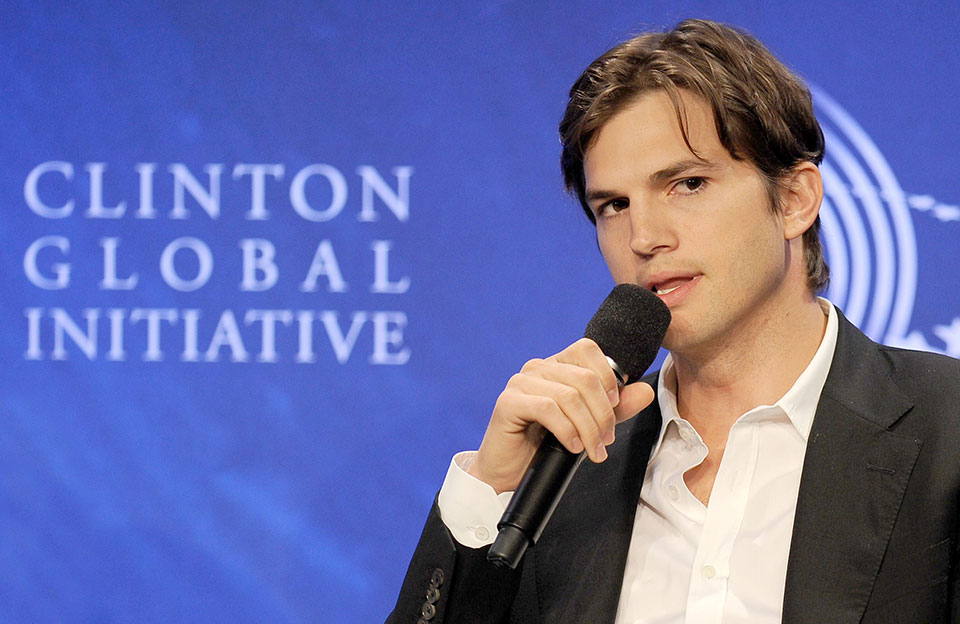

- As part of the reshaping, Tyler Morse, CEO of MCR Hotels, will become vice-chair of the board, while actor-turned-investor Ashton Kutcher, a longtime member, will also join the board.

Expansion and Performance

Founded in 1995 with a single London club, Soho House now operates 58 clubs either open or in development across major cities including London, Paris, New York, Los Angeles, Istanbul, Mumbai, and Bangkok.

Its exclusivity remains a key draw, with 213,000 members paying annual fees of up to £2,920 for global access. The clubs are frequented by celebrities ranging from Kate Moss and Kendall Jenner to the Duke and Duchess of Sussex, who first met at a Soho House in London.

Despite rapid expansion and doubling revenues over the last three years, the company has reported cumulative losses of $739 million since listing, although it has turned a profit in its last three quarters. Shares that once traded above $14 in 2021 closed at $7.64 before the deal announcement.

Investor Pressure and Market Dynamics

The chain has faced scrutiny from activist investors, including Dan Loeb’s Third Point, which pushed for fresh investment and a competitive bidding process. Short sellers such as GlassHouse also questioned Soho House’s accounting practices, though the company dismissed those claims.

Chief executive Andrew Carnie framed the deal as a positive step, stating that returning to private ownership would allow the business to strengthen its brand identity, accelerate growth, and work more effectively with hospitality partners.

“Returning to private ownership enables us to build on this momentum, with the support of world-class hospitality and investment partners,” Carnie said. “I’m incredibly proud of what our teams have accomplished and am excited about our future.”

What This Means

By stepping away from public market pressures, Soho House is betting on its ability to balance exclusive member culture with global expansion economics. With MCR Hotels’ operational expertise and new investment backing, the brand will now look to scale more sustainably while protecting the sense of exclusivity that defines its identity.

Partner With Us

Want to feature your brand, business, or service on 365247 — Whether you’re looking to sponsor, collaborate, or build presence within our ecosystem, we’d love to explore it with you.

Submit your interest here