Despite its meteoric rise as the world’s most valuable company, Nvidia has seen more than $1 billion worth of insider stock sales over the past 12 months—raising eyebrows but not dampening market enthusiasm.

Recent data shows that insiders at the AI chip powerhouse unloaded around $500 million in shares in just the past month. These sales coincided with Nvidia’s shares soaring to fresh record highs, defying macroeconomic volatility and global tech export restrictions. The company’s stock is up 17% year-to-date, and a staggering 44% over the last quarter.

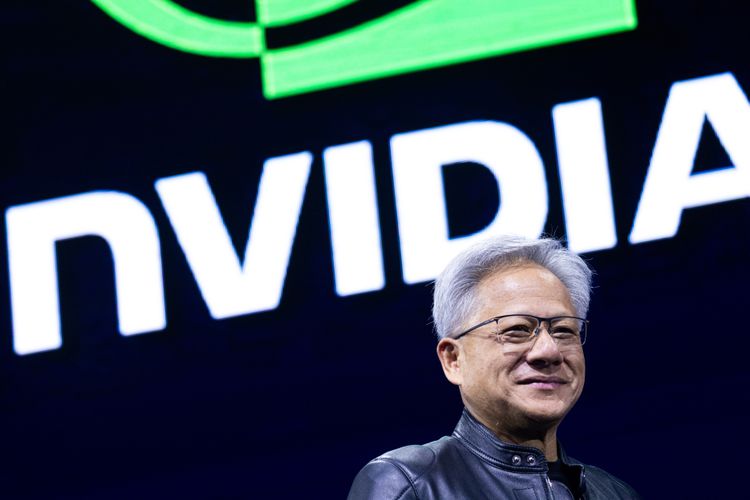

Among those selling is CEO Jensen Huang, who has been executing a pre-announced plan to divest up to 6 million shares over the course of 2024. Roughly $15 million worth of shares were sold recently as part of that plan. Huang’s personal stake remains significant, with a net worth of $138 billion, placing him 11th on the Bloomberg Billionaires Index.

Market Optimism Still Unshaken

Interestingly, Nvidia’s continued rally suggests that investors are unfazed by the insider activity. Following a week of consecutive gains and a bullish shareholder meeting, the company reclaimed its status as the most valuable publicly listed firm, overtaking both Microsoft and Apple.

At the annual meeting, Huang shifted focus beyond AI, describing robotics as the next major growth frontier for Nvidia. The timing of that message, aligned with the stock’s record performance, seems to have further boosted investor confidence—even as insiders reduce their holdings.

Should Insider Sales Matter?

While $1 billion in insider sales might seem concerning on the surface, context is everything.

Here’s what we’re watching:

Pre-planned sales ≠ panic

Most of these divestments were part of long-disclosed trading plans. Such moves are common among executives with large equity positions.

Valuation highs drive portfolio moves

As Nvidia crossed key valuation thresholds—above $150 per share—some insiders may simply be cashing in on historic performance.

Signal vs. noise

Despite the sales, Nvidia continues to attract long-term institutional capital. When the broader market interprets insider selling as financial hygiene rather than red flags, momentum tends to stay intact.

Join the 365247 Community here.

IMAGE: Getty Images