After months of internal recalibration and external pressure, Nike is ready to begin its next chapter.

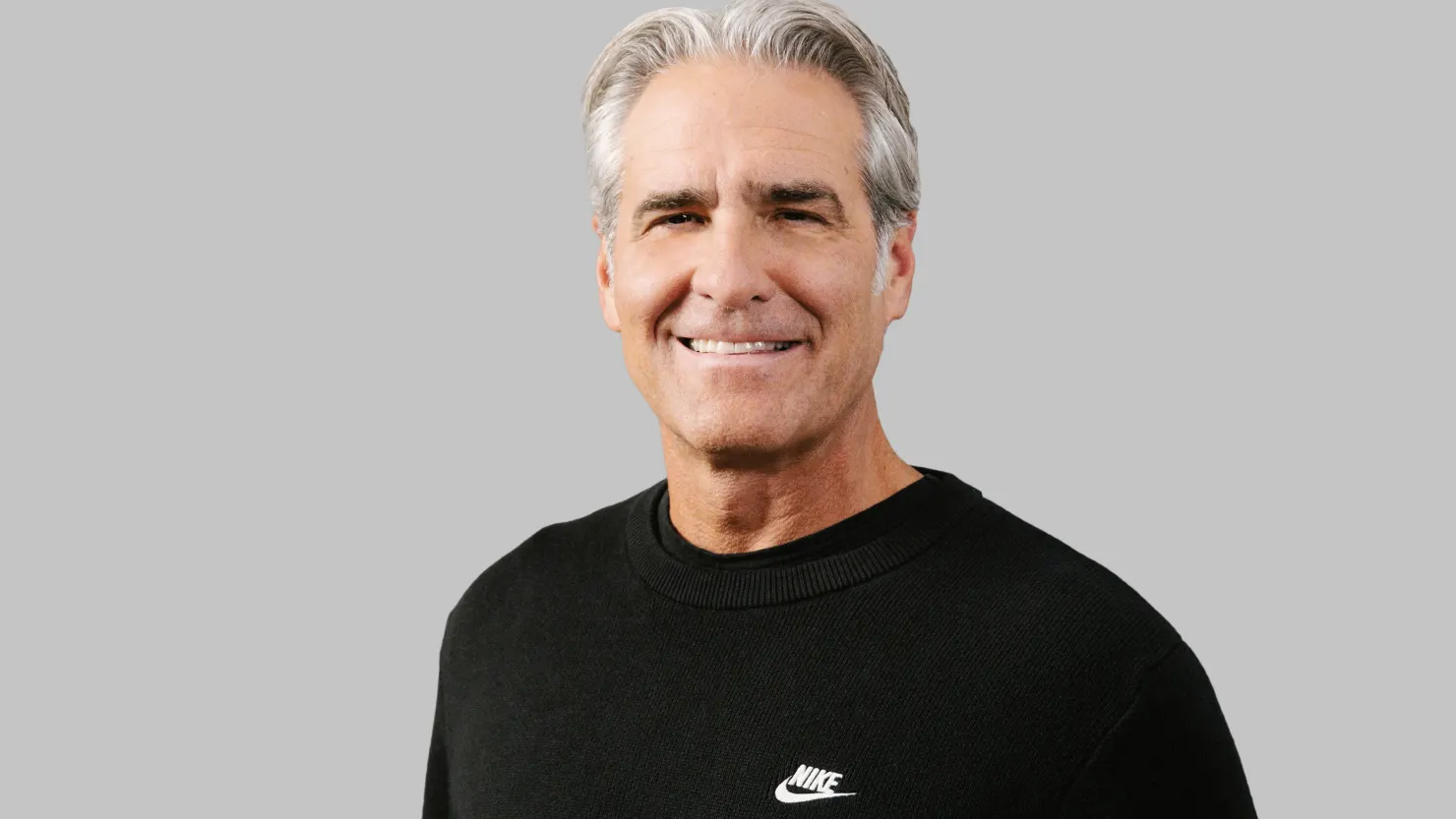

Speaking to investors after the release of the company’s Q4 earnings, President and CEO Elliott Hill admitted that results “weren’t up to the Nike standard”—but emphasized that key structural changes are beginning to pay off. Now eight months into the top job, Hill believes the groundwork has been laid for a long-term rebound.

Financials: A Difficult Year, But Early Green Shoots

For the fiscal quarter ending May 31, Nike’s revenue fell 12% year-over-year to $11.1 billion. Annual revenue was down 10%, landing at $46.3 billion. Profit margins took a sharp hit, with quarterly net income plummeting 86% to $211 million, and full-year earnings dropping 44% to $3.2 billion.

Direct-to-consumer business shrank 14%, while wholesale operations declined 9%. Yet despite the contraction, the company’s stock jumped over 10% in after-hours trading following the earnings call—a sign that markets believe the turnaround may be taking root.

“We’re still in the middle of transformation, but it’s time to turn the page,” said Hill, signaling the start of what he calls Nike’s “Win Now” phase.

A Recommitment to Sport and Product-Led Growth

Since taking over in late 2024, Hill has prioritized reconnecting Nike’s brand identity with its roots in performance sport. His “listening tour” with athletes, designers, and retailers identified a need to refocus on sport-specific innovation, rather than leaning heavily on lifestyle and fashion categories alone.

The strategy appears to be gaining traction in places. Nike’s Vomero running shoe has become a $100 million line, and pre-orders for the upcoming holiday season have already exceeded last year’s numbers—signs that performance-driven products may be regaining consumer interest.

Global Challenges: China, Tariffs & Supply Realignment

Not all hurdles are behind Nike. Sales in Greater China were down 21% in Q4, and the company has acknowledged that a full recovery in that market will take time. Additionally, the brand expects to absorb roughly $1 billion in extra costs from tariffs in fiscal year 2026, which it hopes to offset through price increases and smarter manufacturing realignment.

Chief Financial Officer Matthew Friend said the company is aiming for a “clean and healthy marketplace” by the end of calendar year 2025, with a major focus on reducing excess inventory and repositioning premium offerings.

What This Means for Nike — and the Industry

Nike’s next 12 months will serve as a stress test for whether traditional brand power, athlete partnerships, and supply-chain recalibration can restore profitability in the face of macroeconomic volatility and shifting consumer priorities.

From a consulting lens, here’s what matters:

- Product-Centric Repositioning: Brands seeking long-term relevance must return to core value propositions. In Nike’s case, that means sport performance, not just culture-driven drops.

- Clean Inventory = Premium Perception: Offloading outdated inventory while protecting price points is central to maintaining brand equity.

- Emerging Market Patience: The delay in China’s rebound is a cautionary tale for global brands banking on international expansion without localized agility.

- Tariff Offsets Through Innovation: Margins may not survive blunt pricing tactics alone—tech-enabled supply chain intelligence and custom regional SKUs will be key.

Nike’s current moment is a reminder that even industry titans must evolve—fast, smart, and with humility. Hill’s “turn the page” mantra may sound corporate, but beneath it lies a truth every brand in transition faces:

Reinvention is painful—but the cost of not doing it is far higher.

Need strategic guidance on brand turnarounds, retail repositioning, or athlete-led product strategy?

At 365247 Consultancy, we help brands and businesses unlock the next phase of commercial growth in sport. Let’s talk.

Join the 365247 community here.

IMAGE: Nike