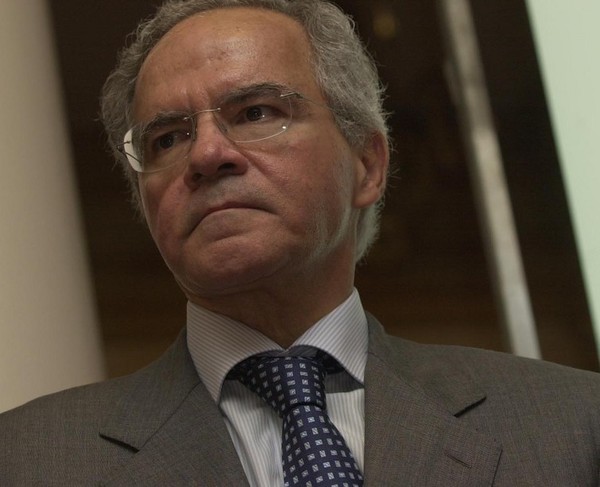

Brazilian businessman Nelson Tanure may step back from his pursuit of a controlling stake in Braskem, Latin America’s largest petrochemical company, as the clock runs down on his exclusive negotiation period without a resolution to a major environmental dispute.

Tanure secured a 90-day exclusivity deal in May to negotiate with Novonor (formerly Odebrecht) over its controlling stake in Braskem. A key condition for the acquisition is a settlement related to ground subsidence in Maceió, a city in northeastern Brazil, where Braskem’s historical rock salt mining operations were linked to the sinking of five neighborhoods and the displacement of thousands of residents. Mining activities there ceased in 2019 following official investigations.

The exclusivity period ends on August 21, and Tanure has made clear that resolving the case — and ensuring new shareholders bear no criminal or financial liability — is essential before moving forward.

Meanwhile, rival bidder IG4 Capital is waiting in the wings. The private equity firm is reportedly preparing an alternative offer that would see Novonor’s bank debt consolidated and swapped for Braskem shares if Tanure’s deal falls through.

The developments come as Unipar is reportedly exploring a separate $1 billion purchase of Braskem’s U.S. polypropylene plants — a move still requiring the approval of key stakeholders, including Tanure and IG4.

365247 Media will continue to monitor this high-stakes battle for control of one of Latin America’s most influential industrial players.

Partner With Us

Want to feature your brand, business, or service on 365247 — Whether you’re looking to sponsor, collaborate, or build presence within our ecosystem, we’d love to explore it with you.

Submit your Interest Here

IMAGE: Valor