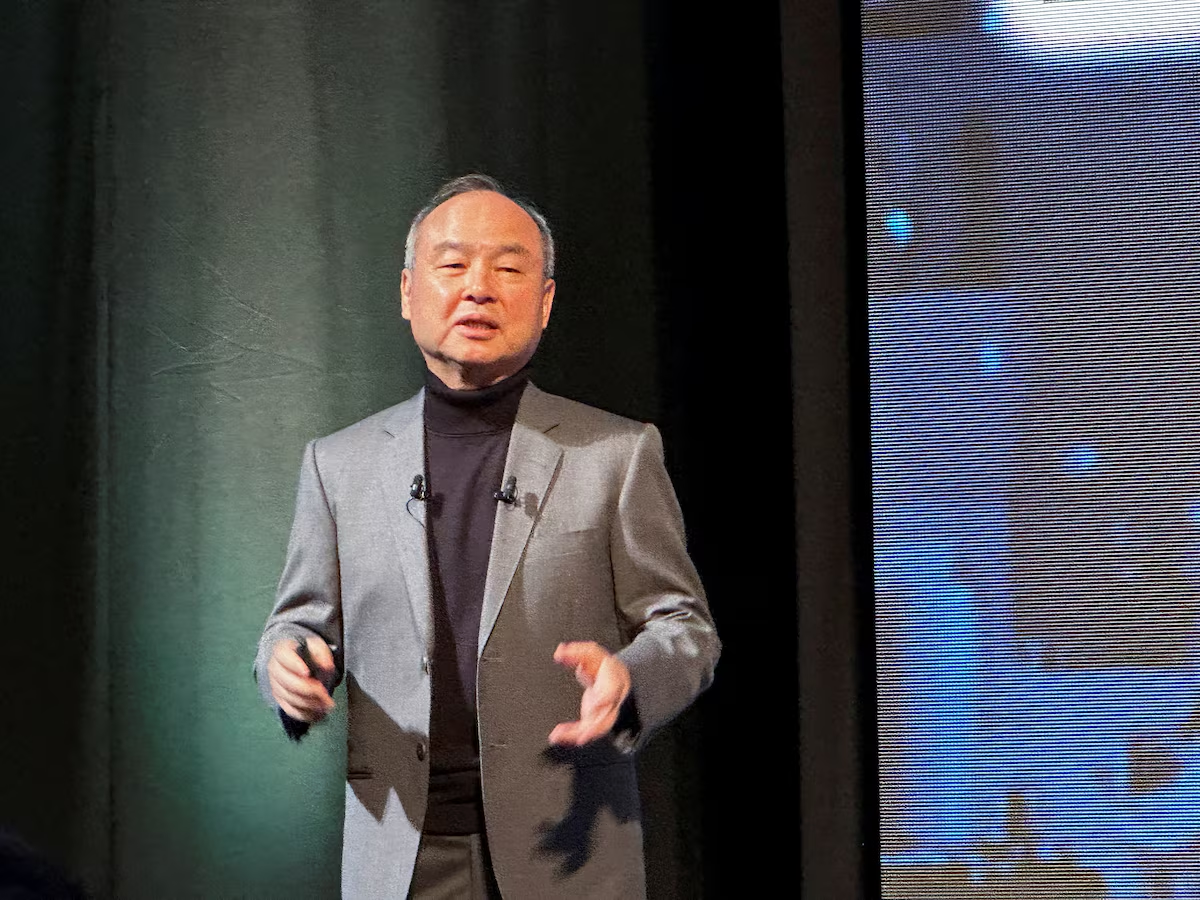

Masayoshi Son, the visionary CEO of SoftBank Group, has set his sights on nothing less than redefining the future of artificial intelligence. Speaking at SoftBank’s annual shareholder meeting, Son declared his intention for the group to become the world’s leading platform for artificial super intelligence (ASI) within the next decade.

This marks a significant pivot for the Japanese investment powerhouse, signaling a new phase of ambition after years of market turbulence and portfolio recalibration.

From High-Stakes Bets to Strategic Dominance

Son’s roadmap is clear: position SoftBank at the very center of the emerging ASI revolution—an evolution of AI that he believes will far surpass human intelligence by several magnitudes. This isn’t simply about software or automation; it’s about shaping the infrastructure and ecosystem that could define the next wave of global innovation.

Comparing SoftBank’s future role to the likes of Microsoft, Amazon, and Google, Son is targeting the kind of platform dominance that thrives on network effects and scale—a “winner takes all” model.

This comes as SoftBank returns to aggressive, high-stakes investing reminiscent of its earlier moves like its groundbreaking early stake in Alibaba. More recently, it has taken significant positions in frontier tech, most notably:

- A $6.5 billion acquisition of Ampere, a U.S.-based semiconductor design firm focused on AI-driven compute

- A multi-billion-dollar stake in OpenAI, with Son revealing that SoftBank has now committed $32 billion to the ChatGPT creator since Autumn 2024

In Son’s own words: “I’m all in on OpenAI.”

SoftBank’s Second Act

The shift to ASI comes after SoftBank spent several years recovering from high-profile setbacks, such as its substantial—and ultimately ill-fated—investment in WeWork. During that period, the group slowed investments and focused on balance sheet recovery, especially as many Vision Fund-backed startups saw their valuations plummet post-2022.

However, the tide turned with the successful IPO of Arm Holdings in 2023, which added a much-needed boost to SoftBank’s financial base. The British chip designer’s share price has soared since its listing, offering SoftBank new leverage to raise debt and fund future investments.

Now, with the tech sector once again in hyper-growth mode, Son is doubling down. Yet he insists that SoftBank’s current investment phase, while bold, is rooted in strategic caution and long-term vision.

“We’ve built the resilience to absorb risk. That’s what enables us to seize the biggest opportunities at the right moment,” Son told shareholders.

The AI Arms Race Intensifies

SoftBank’s aggressive play into artificial super intelligence isn’t happening in a vacuum. Global tech giants are pouring billions into AI development, infrastructure, and chip manufacturing. Nvidia, a former SoftBank holding, has since become a cornerstone of the AI boom and one of the most valuable companies globally.

While Son admits to regretting selling SoftBank’s 5% stake in Nvidia in 2019—just before AI’s renaissance—he is clearly betting that OpenAI and Ampere represent the next frontier.

SoftBank’s ambition to lead in ASI is more than just rhetoric. Backed by newly fortified capital, a sharpened investment thesis, and Son’s relentless belief in exponential technologies, the firm is well-positioned to shape the future of intelligent platforms.

For industry watchers, startups, and global competitors alike—this is a signal. The race toward artificial super intelligence has a new front-runner. And SoftBank intends to organize the entire league.

Join the 365247 Community here.

IMAGE: Reuters