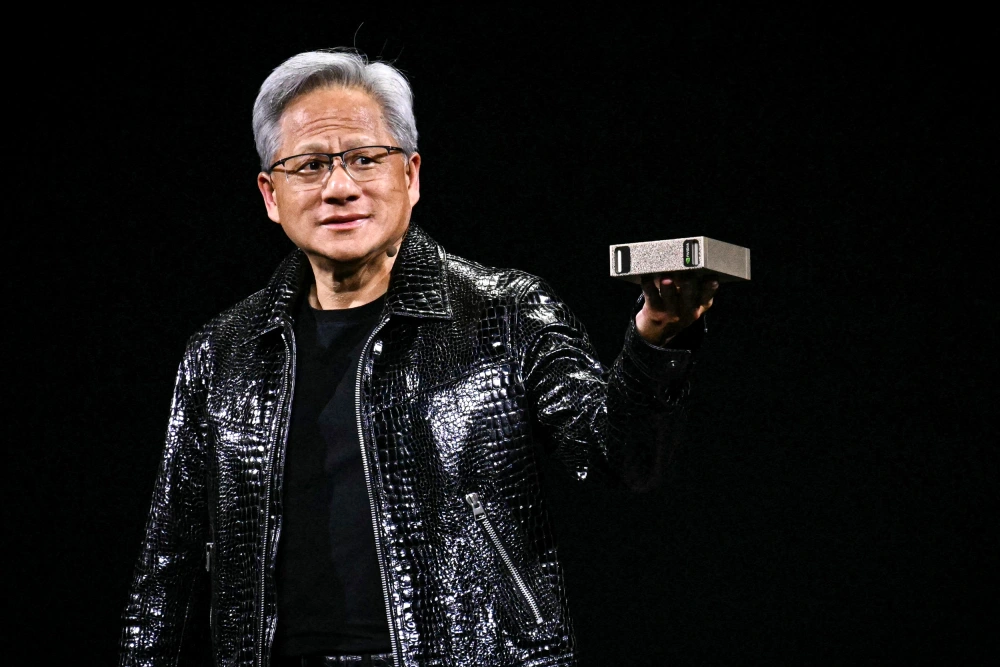

Nvidia’s co-founder and CEO Jensen Huang has initiated a sizable share sale plan, offloading 100,000 shares across a few trading sessions in June—worth roughly $14.4 million. But that’s only the beginning. If completed, his broader sale strategy could exceed $865 million by year-end.

Before the alarm bells go off, here’s what matters: this move is part of a Rule 10b5-1 pre-scheduled trading plan—a common method executives use to sell shares without triggering insider trading concerns. It’s not panic-selling. It’s financial strategy.

Why This Matters

Huang’s decision to gradually reduce his stake comes at a time when Nvidia remains one of the most valuable tech companies in the world, currently part of the $3 trillion club alongside Apple and Microsoft. Even after the planned sales, Huang remains Nvidia’s largest individual shareholder, retaining over 75 million shares directly, with hundreds of millions more held via trusts and partnerships.

The company’s stock price? Still strong. Still outperforming. Still a market darling.

This is not a founder walking away. It’s a founder diversifying at a logical high—and that’s smart.

Strategic Timing or Early Exit?

Some might interpret these sales as a red flag. But the market isn’t flinching. Nvidia shares barely reacted and continue their upward trajectory. Analysts are unbothered. Why?

Because this is not Huang’s first round of high-level sales. A similar plan last year saw him unload 6 million shares, netting over $700 million, all while Nvidia hit record valuations.

And Nvidia’s fundamentals remain bulletproof:

- Demand for Blackwell chips is surging

- Data center revenue is accelerating

- The AI hardware race remains Nvidia’s to lose

Yes, Huang is cashing in—but he’s also doubling down operationally.

Inside Nvidia’s Boardroom Moves

Huang isn’t the only one de-risking. Other top Nvidia leaders have also executed structured sales:

- CFO Colette Kress

- EVPs Debora Shoquist & Jay Puri

- Board director Mark Stevens, who recently sold 600,000+ shares for ~$88M

All of them are selling under similar 10b5-1 plans. For long-term investors, this isn’t necessarily a sign of retreat—it’s a sign of personal wealth management amid market highs.

The Bigger Picture: Leadership + Longevity

Despite Nvidia’s ongoing success, some experts have raised questions about succession transparency. With so many executives realizing gains, corporate governance watchers are keeping a close eye on leadership planning.

But make no mistake: Huang isn’t going anywhere.

His leadership has brought Nvidia to the heart of the AI infrastructure revolution, and his roadmap remains expansive. With the company booking orders into 2025 and powering the world’s AI ambitions, Nvidia isn’t just riding a wave—it’s building the ocean.

365247 Take

This isn’t a sell-off. It’s strategic portfolio pruning at peak performance.

Huang is still all-in on Nvidia. And so is Wall Street.

Join the 365247 Community here.

IMAGE: Getty Images