More than 200 S&P 500 companies have removed words like “diversity” and “equity” from their 2025 annual reports, according to legal intelligence from Freshfields. That’s nearly a 60% drop in mentions of “diversity, equity, and inclusion” across the index.

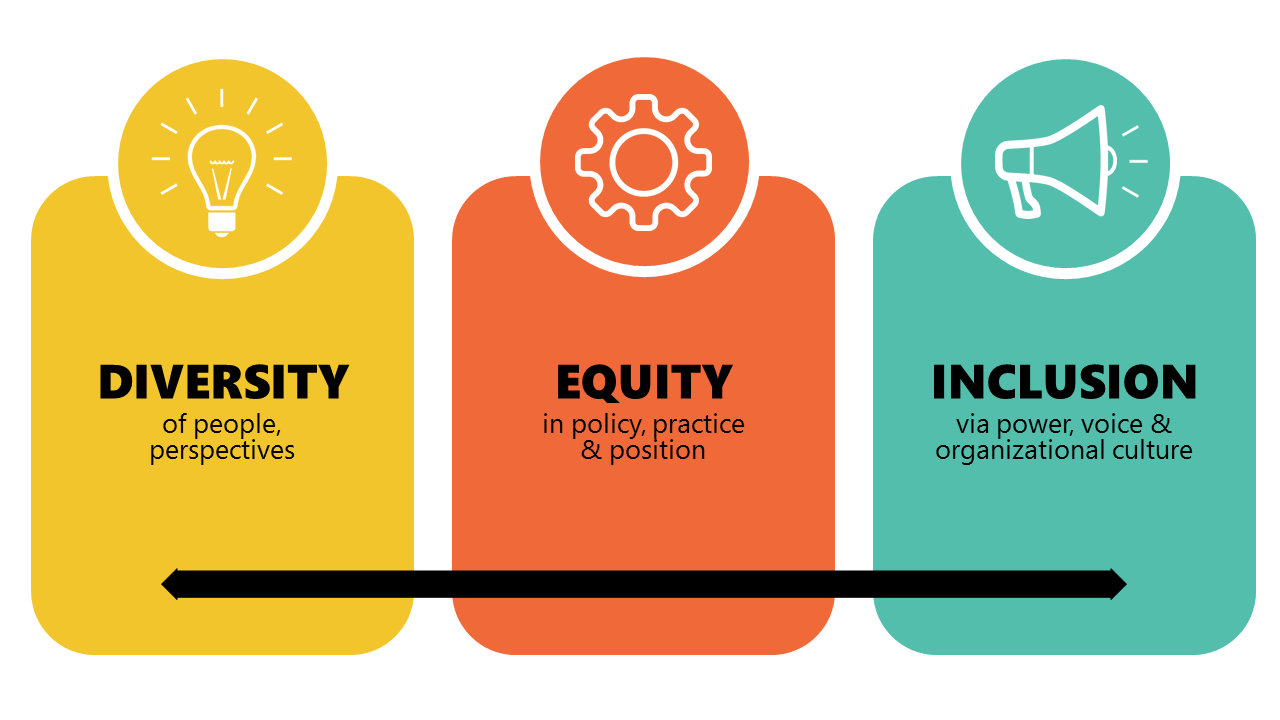

What’s happening? The landscape has changed. With the U.S. administration aggressively rolling back federal DEI mandates, companies like JPMorgan, Meta, and BlackRock are adapting — not by killing inclusion efforts outright, but by reframing them. “Diversity” becomes “opportunity,” “DEI” becomes “connectivity and inclusivity.”

Shareholders are largely staying silent. No pro- or anti-DEI proposal has crossed the 50% threshold this year, and legal complexity around social issues continues to rise with recent SEC guidance.

Strategic takeaway: This isn’t the end of corporate inclusion. It’s the start of a more coded, compliance-aware, and reputationally sensitive era — where the values may stay the same, but the language must evolve. Smart leaders will rebrand without retreating.