Silicon Valley’s AI crown jewel is back on top. Nvidia has surged past Microsoft and Apple to become the most valuable company in the world, riding a powerful wave of investor confidence tied to the rapid acceleration of artificial intelligence.

On Wednesday, Nvidia’s share price jumped 4.33%, closing at $154.31, pushing the company’s market valuation to approximately $3.77 trillion. This marks a historic milestone as the chipmaker reclaims its spot at the summit of global equity markets.

AI Optimism Fuels Momentum

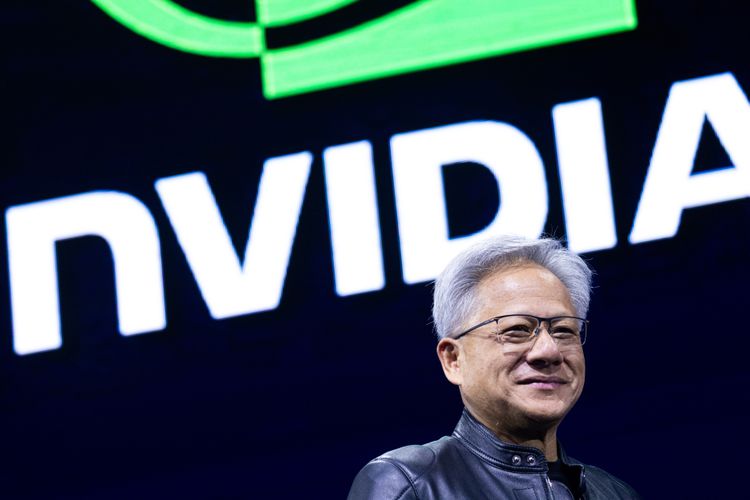

The surge came on the heels of Nvidia’s annual shareholder meeting, where CEO Jensen Huang showcased the company’s latest advancements in AI hardware and infrastructure. Huang reaffirmed Nvidia’s position at the center of the global AI revolution, emphasizing that the transformation of computing through AI is only just beginning.

This narrative continues to strike a chord with investors. As AI reshapes industries—from healthcare and finance to manufacturing and entertainment—Nvidia remains one of the clearest beneficiaries of this seismic shift.

Wall Street Backs the “Golden Wave”

Brokerage firm Loop Capital responded swiftly, lifting its price target for Nvidia to $250 from $175, while maintaining a “Buy” rating. The firm described Nvidia as a key player in what it termed a “Golden Wave” of global AI adoption.

Meanwhile, Microsoft and Apple continue to hover in the top tier, closing the day with market caps of $3.66 trillion and $3.01 trillion, respectively. However, neither has matched Nvidia’s meteoric momentum in 2025.

A Multi-Year Rally Built on AI Leadership

Nvidia’s stock trajectory has been nothing short of explosive:

- +240% in 2023

- +170% in 2024

- +17% and climbing in 2025

While the company’s stock has soared, its valuation remains grounded in solid fundamentals. Nvidia currently trades at about 30 times forward earnings, below its five-year average of 40x—indicating that earnings are growing even faster than the share price.

Looking Ahead: Infrastructure, AI, and Beyond

The story isn’t just about graphics chips anymore. Nvidia’s footprint now spans data centers, AI training clusters, edge computing, and foundational models. The company has effectively become the infrastructure layer for the AI era—something investors, institutions, and entire industries are beginning to price into their strategies.

Bottom Line: Nvidia’s rise is a reflection of a deeper macro shift. As AI becomes central to how economies operate, companies enabling its foundation—like Nvidia—are poised to define the next decade of global tech dominance.

Join the 365247 Community here.

IMAGE: Getty Images