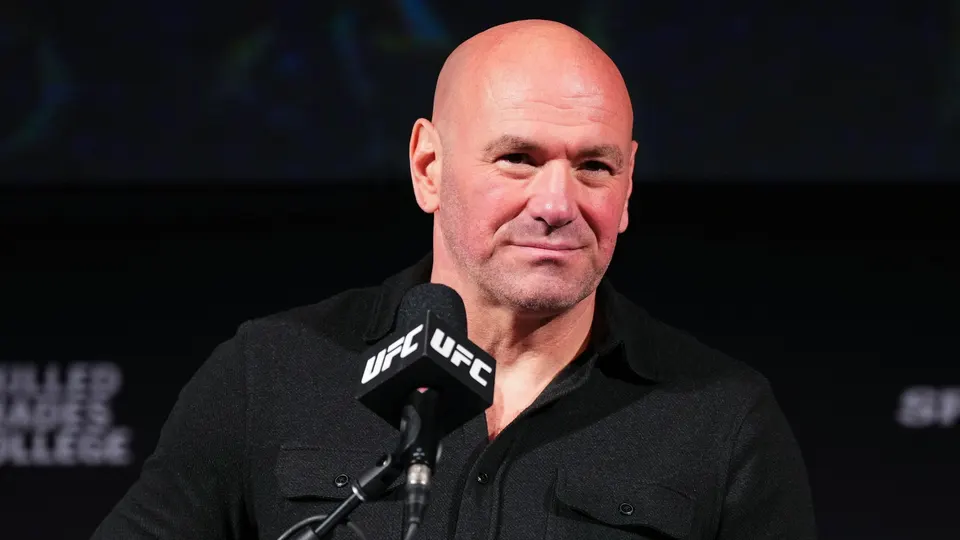

As the UFC enters the final stretch of its $300 million-a-year media deal with ESPN, the world’s premier mixed martial arts (MMA) organization is eyeing a seismic shift in how its content reaches fans. With ESPN’s exclusive negotiating window now closed, UFC President Dana White has hinted that a multi-platform media model is on the cards—ushering in a new era that could redefine the UFC’s broadcast and digital future.

The $1 Billion Ambition

UFC’s parent company, TKO Group Holdings, is reportedly targeting $1 billion annually from its next U.S. media rights agreement—a bold figure, but one that reflects the UFC’s meteoric growth. From global expansion to consistently strong pay-per-view numbers, the UFC has become one of sport’s most bankable properties. And with digital engagement and younger audiences driving media evolution, the timing is strategic.

Who’s in the Octagon?

According to insiders, there are four key contenders:

- ESPN (the incumbent)

- Amazon Prime Video

- Netflix

- Warner Bros. Discovery

Each brings unique advantages. ESPN offers established sports credibility. Amazon and Netflix bring global distribution muscle and access to Gen-Z viewers. Warner Bros. could provide cable-scale reach with a hybrid model.

Netflix’s recent moves—snatching up WWE’s RAW and debuting Zuffa Boxing with a Canelo-Crawford showdown—underline its ambition. With the success of RAW on the platform (4.9 million global views on debut), Netflix is proving its capability to deliver live combat sports at scale.

The Streaming Reality: A New Era for UFC

The consensus? Streaming is no longer a gamble—it’s the main event. And with WWE, boxing, and likely UFC all under one digital roof, Netflix could soon be the global home of combat sports.

But exclusivity might not be in the UFC’s best interest.

Split Rights: More Revenue, More Reach

The smarter play could be a split-rights model, where UFC segments its content across platforms—retaining flagship pay-per-view events on one service, while offloading Fight Nights, Contender Series, or archival content to others.

This strategy:

- Maximizes competitive bidding

- Appeals to diverse audiences

- De-risks reliance on one distributor

- Drives platform innovation and fan engagement

It mirrors what the NFL and Formula 1 have explored: fragment content to multiply value and fuel global growth.

The Flip Side: Fragmentation Fatigue

Of course, splitting content can overwhelm fans. Navigating between platforms, paying for multiple subscriptions, and deciphering broadcast schedules may erode viewer loyalty or drive piracy—something already impacting other sports like European football.

There’s also the challenge of balancing multiple partners’ expectations, tech infrastructure, and promotional obligations. It’s a more complex but potentially more lucrative future.

The Real Battle Is Strategic Alignment

As UFC weighs its next media move, the bigger story isn’t about platforms—it’s about positioning.

The UFC has evolved from niche sport to cultural mainstay. Its next deal must do more than deliver dollars; it must:

- Build long-term brand equity

- Expand into emerging markets

- Increase access without alienating fans

- Leverage data and interactivity to reinvent viewer experience

Done right, this isn’t just a broadcasting shift. It’s a strategic repositioning of combat sports in the digital economy.

At 365247 Consultancy, we work with sports properties, rights holders, and platforms to:

- Craft next-gen media rights strategies

- Negotiate multi-partner distribution models

- Innovate digital fan engagement

- Design anti-fragmentation frameworks

Schedule your introductory call here.

Join the 365247 Community here.

IMAGE: Getty Images